DIDJA JUST BUY A HUGE TRUCK OR SUV? OIL PRICES SET TO CLIMB AGAIN

BY DAN VALENTI

PLANET VALENTI NEWS AND COMMENTARY

(FORTRESS OF SOLITUDE, TUESDAY, NOV. 24, 2015) — When a gallon of gas was approaching $4 a gallon, concerns for high prices were rampant. Now that they are the lowest seen in some time, you’d think the worries would be over. Ah, but this is the economy, an entity and phenomenon no one understands, least of all economists. Of course, that’s why they consider themselves experts.

In an effort to arm you with information, THE PLANET presents this guest column from our colleague Summit Roy at ETF.com. Feel free to share your views. ETF.com is one of the world’s leading authorities on exchange-traded funds.

——– 000 ——–

Here’s The Real Story Why Oil Prices Will Spike

We are in the midst of the worst oil bust in decades. The industry hasn’t been in this bad shape since 1999, or perhaps as far back as 1986. With prices spiraling down to less than $40 a barrel, companies have been forced to slash their drilling activities dramatically, while cutting thousands of jobs.

In sharp contrast, consumers are rejoicing. The average gasoline price in the U.S. may fall below $2 a gallon later this year for the first time since 2009, according to AAA. That’s spurred a boom in car sales, particularly for large trucks and SUVs.

Things certainly look great for consumers and horrible for producers, but don’t get used to the current situation.

Production Falling Off A Cliff

The biggest culprit for oil’s plunge starting in the middle of 2014 was the enormous growth in U.S. shale production. Output in the country had grown by nearly a million barrels per day for three-straight years up until that point, and the market simply couldn’t absorb that breakneck pace of growth anymore.

Prices cratered from more than $100 a barrel in July 2014 to less than $45 in early 2015 (they later moved even lower to $37.75 in August of this year).

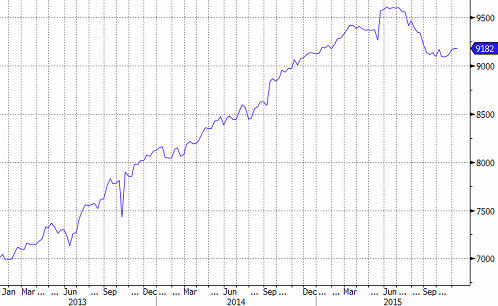

Crude Oil Prices

Compounding the oil market’s problems was a surprise decision by the Organization of the Petroleum Exporting Countries (OPEC), led by Saudi Arabia, to increase its production to punish and steal market share away from U.S. producers.

OPEC’s strategy worked, and now U.S. output is tumbling on the back of reduced drilling, with daily production down 500,000 barrels from its high of 9.6 million barrels per day.

U.S. Oil Production (thousand barrels per day)

Source: Energy Information Administration

But low prices have taken their toll on the cartel as well, with some member countries faring worse than others. Saudi Arabia may be in a relatively comfortable position to weather the storm, but countries like Venezuela, Nigeria and Libya have seen their economies decimated as they struggle to maintain current production with significantly less cash coming in.

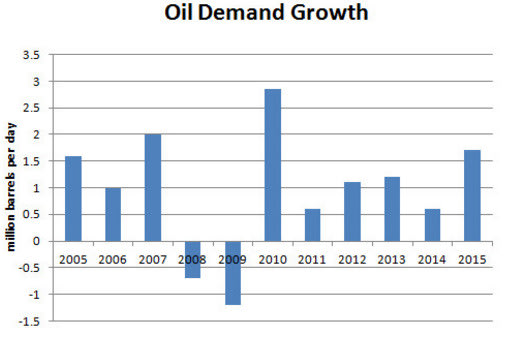

Demand Skyrocketing

At the same time that supply struggles, demand is headed the other way. According to the International Energy Agency, consumption is on track to increase by 1.8 million barrels per day this year, the fastest pace of growth in five years.

Source: International Energy Agency

That may come as a surprise to some people who expected the slowdown in China to have more of a negative impact on demand. These figures suggest that the benefits of lower prices on demand far outweigh any slowdown in China or other emerging markets.

As long as prices stay low, there’s no reason to expect demand to slow down anytime soon. The record-breaking car sales in the U.S. are a reflection of that, and the new gas-guzzling trucks and SUVs that are bought this year will stay on the roads for years to come.

Prices To Rebound

If the outlook for supply and demand is so bullish, why haven’t prices rebounded already?

That’s because, as it stands now, supply continues to outpace demand. The big 2.5 million-barrel-per-day jump in OPEC production since the middle of last year―primarily from Saudi Arabia and Iraq ―has outpaced even the massive increase in demand.

Saudi Arabia Oil Production (thousand barrels per day)

Source: Bloomberg

Iraq Oil Production (thousand barrels per day)

Source: Bloomberg

But with OPEC now pumping full tilt, the cartel is effectively maxed out. As U.S. output heads lower, supply on a global basis is tilted to the downside.

If demand rises another 1.5 million barrels per day or more in 2016, that could finally shift the oil market into a deficit, lowering inventories and sending prices spiking.

The International Energy Agency expects demand to begin outpacing supply in the second half of next year. If that happens, prices must rise high enough to spur renewed investment in oil wells, particularly in the U.S., where new production can come online relatively quickly.

Pira Energy Group, a firm highly regarded for its energy price forecasts, says that it takes nine months for U.S. companies to bring new production on stream once it becomes profitable to drill again.

Analysts have a wide range of opinions on what price level will be required to incentivize U.S. oil companies to invest in new wells again. Pira suggests that oil will climb to $70 by the end of 2016 to encourage producers to drill. That would be a whopping 75% increase in prices from current levels near $40.

Risks To The Outlook

Of course, no forecast is without its risks. While the fundamentals seem to be lining up to send oil much higher a year from now, if demand disappoints due to much slower global economic growth than expected, that would throw a wrench into this bullish outlook.

On the supply side, the biggest threat to the outlook comes from Iran. The country promises to increase its exports next year as sanctions are lifted. If that happens, that could add another 600,000 barrels per day to global supply, according to the International Energy Agency, keeping the market oversupplied for a while longer.

Editors Note: ETFs that could spike along with oil include the Energy Select SPDR (XLE | A-90), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP | A-58) and the Market Vectors Oil Services ETF (OIH | A-49).

There you have it, information that might want you to double down in oil stocks or play the contrarian, betting that oil prices have not hit bottom.

——————————————————————————————–

“Democracy is the pathetic belief in the collective wisdom of individual ignorance.” — H.L. Mencken

“OPEN THE WINDOW, AUNT MILLIE.”

LOVE TO ALL.

The views expressed in any comment section are not those of PLANET VALENTI or endorsed in any way by PLANET VALENTI; this website reserves the right to remove any comment which violates its Rules of Conduct, and it is not liable for the consequences of any posted comment as provided in Section 230 of the Communications Decency Act and PLANET VALENTI’s terms of service.

Did anyone else catch the reference Sunday evening on The Simpson’s to “Pittsfield”?

Towards the very end of the show, someone, either Homer or the Bartender or one of the other regulars, says to this old Broadway broad, an aging out-of-favor former big star, “See you in Pittsfield!”

Hilarious!

Plus how many in The Simpson’s audience ever even heard of Pittsfield, let alone know where it is or even what state it’s in?

Since The Simpsons is supposedly set in Illinois, I’m assuming they meant the one there.

Build the pipeline

Lower my Energy bills

I agree. Building the pipeline is the only sensible solution to a country with a growing population and rising energy needs.

The building of that pipeline will enable NatGas to be exported out of the US in massive amounts. This in turn will lead to the lowering of US inventories bring a price rise as well as price spikes.

NatGas….. The new Darling for energy Speculators…. Hold onto your seats!!!

Many, many, many concerns about the no referendum vote on the new Taconic, their were many proponents that spoke affirming a new school, one in particular is the host of WTBR, John Krol and a current co host Bill Sturgeon, who along with Krol spoke in favor of a new high school, Sturgeon at open mike, subsequently is currently co hosting a student sponsored radio program, how is this?The program does not qualify by students standards of programming, and is often just one big political grab for the host and now co host. Shame on Dr. McCandless for this political, non student orientated programming. Surprised the F C C let’s this current situation continue.

Another taxpayer funded tool in the GOB toolbox. Got to give them credit. They know how to work the system to their advantage and have their bases covered should there be any backlash. Krol will be rewarded sometime in the future for his part in it.

Shame on McCandless for allowing this hijacking of a student resource by the commercial interests of two public leeches.

The show itself was used to show fear into hearts of the taxpayers, they have advertised and advanced the new project by showing water stains on the ceilings for instance, and have had many proponents for a new school speak on the shows. I don’t watch the show that often, but haven’t seen a guest on the show against the new school, but more importantly haven’t heard a need for a referendum vote? Other than the student robots brought out by the G O Bees, no student I’ve talked to complains about the current problems at the school, they even like it?

Why was THS allowed to get into such a bad state?

Didn’t Simonelli notice anything wrong during his 20+ years there?

What did he do about it?

What about the buffons on the cc, sc, and all the mayors since 1969? Why did they let this happen?

It really looks like the fix is in.

Remember the long gas lines of the 70’s? We were told that they are running out of oil.

Remember “peak oil”? We were told that they are running out of oil.

The whole idea for OPEC was originated by our ex Richard Nixon.

Under George W. Bush, the price of petro just about bankrupted this country. The high price of oil trickles down to damage every part of the economy.

Truth is, there is no economic recovery. Nobody believes the numbers the government or the media spews. Gasoline under $2.00 per gallon is just an attempt to revive the dead economy. A day late and a dollar short.

In Venezuala, the citizens pay .17 cents a gallon. After being greeted as liberators in Iraq, why do they not sell us their oil cheap? Instead, they sell to Russia and China who did invade them.

$20 Trillion dollars in debt. We are. Do you know how much a trillion dollars is? The taxes collected only go to pay the interest on that debt. Raise the debt ceiling. Borrow more money, just to keep the government going.

You don’t have to be an economist to foresee what is going to happen. The “experts” are indoctrinating their students that there is an economic recovery going on. The same students who owe a record amount of massive debt in student loans from which they cannot file bankruptcy.

Notice that even thought he price of everything shot way up when the cost of gasoline went up they never came back down when the price dropped. The savings on these transportation costs should have been passed on but instead went into greedy pockets.

Which reminds me. I was wondering if any of our city councilors ever bothered to find out how much our city saved on budgeted gasoline last fiscal year. Had to be a pretty penny with all the city vehicles sucking it up every day but every time I ask the question no one responds. Money probably disappeared and they would rather no one probed the matter.

correction:

“did not invade them”

Off topic.

Their is a story of a Dalton police officer in the local rag. If this event transpired in Pittsfield it would have been deemed a “personnel issue” and never hit the paper.

The Classic was buying new buses and the old ones aren’t paid for, and in the Winter, don’t even have salt down for these contraptions.

Not even sure the bonds for the renovations of the elementary and middle schools are paid for.

They are not. According to city records published by Dv the city (taxpayers) still owe more than $22 MILLION on these renovations.

Which will increase faster: (a) gas prices, or (b) Pittsfield politics’ municipal taxes?

It’s all about supply and demand Danny Boy! Off topic, but we need jobs, like yesterday! What happened to that Rolodex, is he going to let Tyer use it? Ha!

The Rolodex is on loan to the Milt Plum Archives and Museum on 4th St.

Does one really know if the

Russian Jet was shot down, do we trust automatic his word……NO!

Regarding the new Taconic High School: If the G man was elected the project would have been stopped and a reduction in taxes begun.

But the old one had dirty ceilings

I have ready numerous articles concerning Taconic High school. Not one mentioned any structural issues with the building. I heard about the need for new roof, doors, windows and heating system. If I am mistaken, could someone enlightened me. Not bad bones, just bad skin.

They shut a lone speaker at open mike down, at 3 minutes and 17 seconds, it ain’t right, it’s blooming ridiculous!

The silly council is looking to reduce the free cash..Curious to see what the Scanlon’s will say about it?

I hope the great Planet is watching the ridiculous back and forth between Barry and Sue, it’s blooming ridiculous. With the Planet’s o k , would like to grade these Bozo’s after the meeting….a final grade if you will? Tully looks confused.

Manda, Lothrop isn’t a NUMBers guy, so give him an automatic fail, for old time sake.

Krol said it will be somewhere in the middle, tax rate. How does he know this? They are full of it. When Scanlon’s gets there, it doesn’t mean anything without their o k.

I like Barry’s six percent increase.

It’s a game, Local. One says low, the other goes high, but in the end they all meet in the middle, if the vote goes haywire, then they bring in the filibuster brothers to tell us free cash and how it will the effect the bond rating bla bla bla. Who’s kidding who. Their getting punchy, another said, it’s my last vote, another said Incredulously, it wouldnmt be to much of a burden. We can’t afford any increase. Start cutting, start with the Schools.

Better yet, vote Gaetani next time, you fools.

The school votes don’t mind paying an increase, they’ll pay it with thier raises they received from Free Cash. Cr@igs not there?

Ahhh, more smart growth at Slumber land Farms on First street. I would suggest instead of putting a gasoline sight at the Bland Electric Building next to the current Cunberland building,put a new Police station on that site as our officers are over there with problems just about every day anyway.

ATTORNEY Sid for Cumbies just stated there will be an uptick in police presence with the new site, but this is just what that area needs, more littering and more tanks in the ground in a neighborhood, and more crime. is the idea to shop and buy cigs and coffee, then gas up? get Real? The lawyer said a better policed site? PPD is stretched as it is.